🍣 SushiSwap: Dive Into DeFi Deliciousness

In the ever-evolving world of decentralized finance (DeFi), SushiSwap stands out not just because of its quirky name, but because of its powerful, community-driven approach to crypto trading. If you're curious about how SushiSwap works, why it's become a staple in the DeFi menu, and how to get started with it—pull up a seat. This blog is your full-course guide to everything SushiSwap!

🧠 What Is SushiSwap?

SushiSwap is a decentralized exchange (DEX) built on the Ethereum blockchain. It allows users to swap, stake, lend, and earn crypto—all without the need for a traditional centralized intermediary like Binance or Coinbase.

SushiSwap was forked from Uniswap in August 2020 but added some spicy extras like:

- SUSHI tokens for governance and rewards

- Yield farming and liquidity mining

- Cross-chain integrations

- A fully decentralized DAO

And yes—true to its name, everything is wrapped in fun sushi-themed branding. 🍣

💥 Key Features of SushiSwap

Let’s break down what makes SushiSwap such a powerful player in the DeFi space:

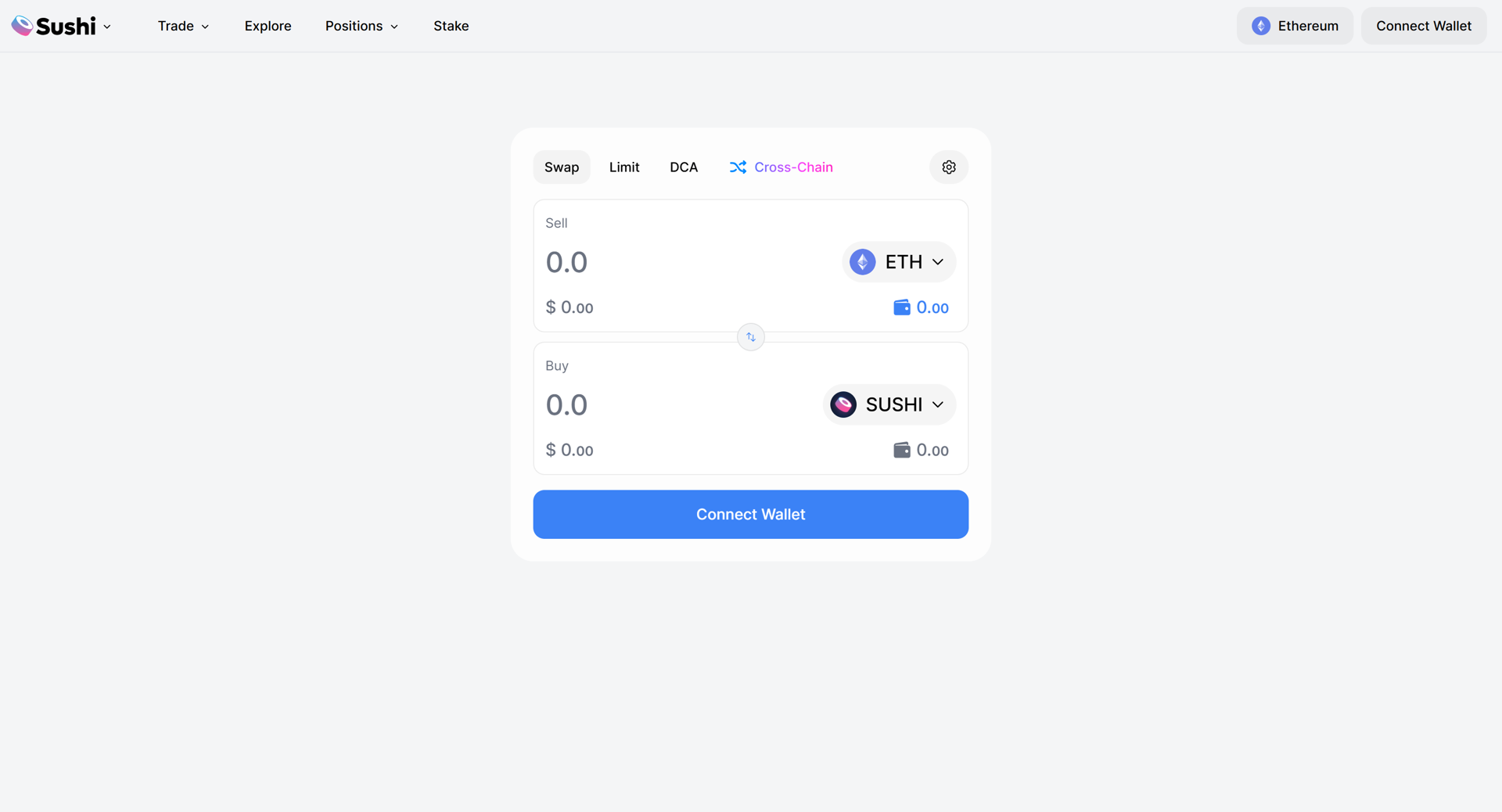

🔄 Swap

SushiSwap allows users to trade crypto directly from their wallets. No accounts, no KYC—just connect your wallet and swap ERC-20 tokens instantly.

💧 Provide Liquidity

You can add your crypto to a liquidity pool and earn rewards. In return, you get LP (Liquidity Provider) tokens, which represent your share of the pool.

🌾 Yield Farming

Stake your LP tokens into SushiSwap farms and earn SUSHI tokens. This incentivizes users to provide liquidity and keeps the platform liquid and healthy.

🗳️ Governance

SUSHI holders have voting rights and can shape the future of SushiSwap. It's a truly decentralized community where your voice matters.

🌉 Cross-Chain Swaps

SushiSwap isn’t limited to Ethereum. It now supports multiple blockchains, including:

- Polygon

- Binance Smart Chain (BSC)

- Fantom

- Arbitrum

- Optimism

- Avalanche

This multi-chain expansion makes SushiSwap ultra-versatile and cost-effective, depending on your chosen network.

🧩 How SushiSwap Works

SushiSwap operates on an automated market maker (AMM) model. Unlike traditional exchanges that use order books, AMMs use liquidity pools to facilitate trades.

Here’s a basic flow:

- Alice wants to trade ETH for USDC.

- She goes to SushiSwap and connects her wallet.

- SushiSwap fetches a rate from the ETH/USDC liquidity pool.

- Alice approves and confirms the swap.

- Her ETH goes into the pool, and USDC comes out at the calculated rate.

The AMM algorithm adjusts prices based on supply and demand using the formula x*y=k, where x and y are the token balances in the pool, and k is a constant.

🍱 What Are SUSHI Tokens?

The SUSHI token is more than just a fun name—it’s the lifeblood of the SushiSwap ecosystem. Here's what you can do with it:

🧧 Earn Rewards

Earn SUSHI by providing liquidity or staking LP tokens in Sushi farms.

🪙 Stake in xSUSHI

Stake your SUSHI to receive xSUSHI, which earns a portion of all trading fees on the platform. It's like getting dividends from a stock.

🏛️ Vote on Proposals

As a SUSHI holder, you can vote on community proposals like new features, fee structures, or developer grants.

🛠️ How to Use SushiSwap – A Step-by-Step Guide

Ready to get started? Here’s a beginner-friendly guide:

🥢 Step 1: Set Up a Wallet

You'll need a Web3 wallet. The most popular options include:

- MetaMask

- Coinbase Wallet

- Trust Wallet

Install the wallet, create your seed phrase, and secure it offline.

🥡 Step 2: Buy ETH (or any supported token)

Buy ETH or another supported asset via a CEX like Binance or Coinbase and transfer it to your wallet.

🍙 Step 3: Go to SushiSwap

Navigate to sushi.com. Click “Launch App”, connect your wallet, and select the correct network (Ethereum, Polygon, etc.)

🍤 Step 4: Swap Tokens

Choose the token you want to trade from and the token you want to receive. Click Swap, confirm in your wallet, and voila!

🍶 Step 5: Add Liquidity (Optional)

Click on “Liquidity”, choose a pair (like ETH/USDT), and deposit both tokens. You’ll receive LP tokens in return.

🍚 Step 6: Farm and Stake

Go to “Farm”, find the right pool, and stake your LP tokens to earn SUSHI!

🔐 Is SushiSwap Safe?

SushiSwap is open-source and has been audited by several blockchain security firms. That said, no DeFi platform is 100% risk-free.

🛡️ Risks to Consider:

- Smart contract vulnerabilities

- Impermanent loss when providing liquidity

- Rug pulls (less common now with established platforms like SushiSwap)

- Gas fees (high on Ethereum, lower on Layer 2s and other chains)

Always do your own research (DYOR), and never invest more than you can afford to lose.

🌍 The SushiSwap Ecosystem

SushiSwap isn't just a DEX—it’s a whole DeFi ecosystem:

🍣 BentoBox

A vault system that enables multiple dApps to share capital efficiently. It powers features like Kashi lending and Trident AMM.

🥟 Kashi Lending

A lending and margin trading platform that uses isolated lending pairs. This minimizes the risk of bad loans affecting the entire pool.

🍱 Trident

An advanced AMM framework that lets users create custom pools with different price curves, optimized for performance and flexibility.

📈 SushiSwap vs. Competitors

FeatureSushiSwapUniswapPancakeSwapGovernance Token✅ (SUSHI)✅ (UNI)✅ (CAKE)Cross-Chain✅⚠️ (Limited)✅Yield Farming✅⚠️ (Via 3rd parties)✅Lending/Margin✅ (Kashi)❌⚠️ (Limited)Fee Sharing✅ (xSUSHI)❌⚠️

🔮 The Future of SushiSwap

SushiSwap has gone through ups and downs, including leadership changes and governance drama. However, the resilient community, the DAO structure, and ongoing innovation have kept it alive and growing.

Future upgrades include:

- More Layer 2 integration

- Enhanced UI/UX

- Mobile app launch

- Sushi 2.0 with improved protocol economics

✅ Final Thoughts

SushiSwap is much more than a Uniswap clone—it’s a multi-functional, community-owned DeFi hub that offers real utility and rewards for users. Whether you’re a trader, a yield farmer, or a governance geek, SushiSwap has something for you.

So why not give it a try? Who said investing in crypto couldn’t be delicious? 🍱🍣

🔗 10 Times Keyword Link – SushiSwap

- Learn more about SushiSwap on their official website.

- Discover how SushiSwap enables DeFi swaps with low fees.

- Provide liquidity on SushiSwap and earn rewards.

- Stake your assets in SushiSwap farms for passive income.

- Use SushiSwap across multiple blockchains like Arbitrum and Polygon.

- Explore governance on SushiSwap with the SUSHI token.

- Swap tokens instantly on SushiSwap without registration.

- Discover SushiSwap's BentoBox and Kashi lending protocol.

- Track your farming rewards live on SushiSwap.

- Join the SushiSwap community and shape the future of DeFi.

Made in Typedream